This option gives you the speed of an online application with the added benefit of easier access to customer service representatives. You can apply for a Citi credit card over the phone by calling our consumer line 1-80. You can apply for a Citi credit card online today. There is no right destination to file a credit card application, but let's look at some of the basic options: OnlineĪpplying for a credit card online may be the quickest way to file an application. Now that you've found the right credit card and gathered all of your important documentation, you'll need to find the right way to file your application. You don't want to use your card for six months to find a surprise change to your interest rate. Make sure to understand these terms-especially the interest rates, repayment terms, and default conditions-before you go ahead with the application. Understand the terms on your credit card applicationĮvery credit card application will state the standard terms and conditions for using the card. is up to date if you're a younger applicant.ĥ. The minimal age for cardholders is eighteen, so make sure your I.D. Proof of age: Often you will need a second form of identification both for security and for age requirements.

verification: You will need a social security number (SSN) or individual taxpayer identification number (ITIN) both to verify your identity and protect you from fraud. Financial documentation: While some banks may not ask for proof of income, it is a good idea to have these documents on hand, even if you only need to report a gross income on your application.These will be standard documents, such as: Learn the Requirements to Apply for a Credit CardĪfter you've decided what card you'll use, you'll need to gather all the necessary documents for your credit card. Keep this in mind when looking at card pre-approvals.

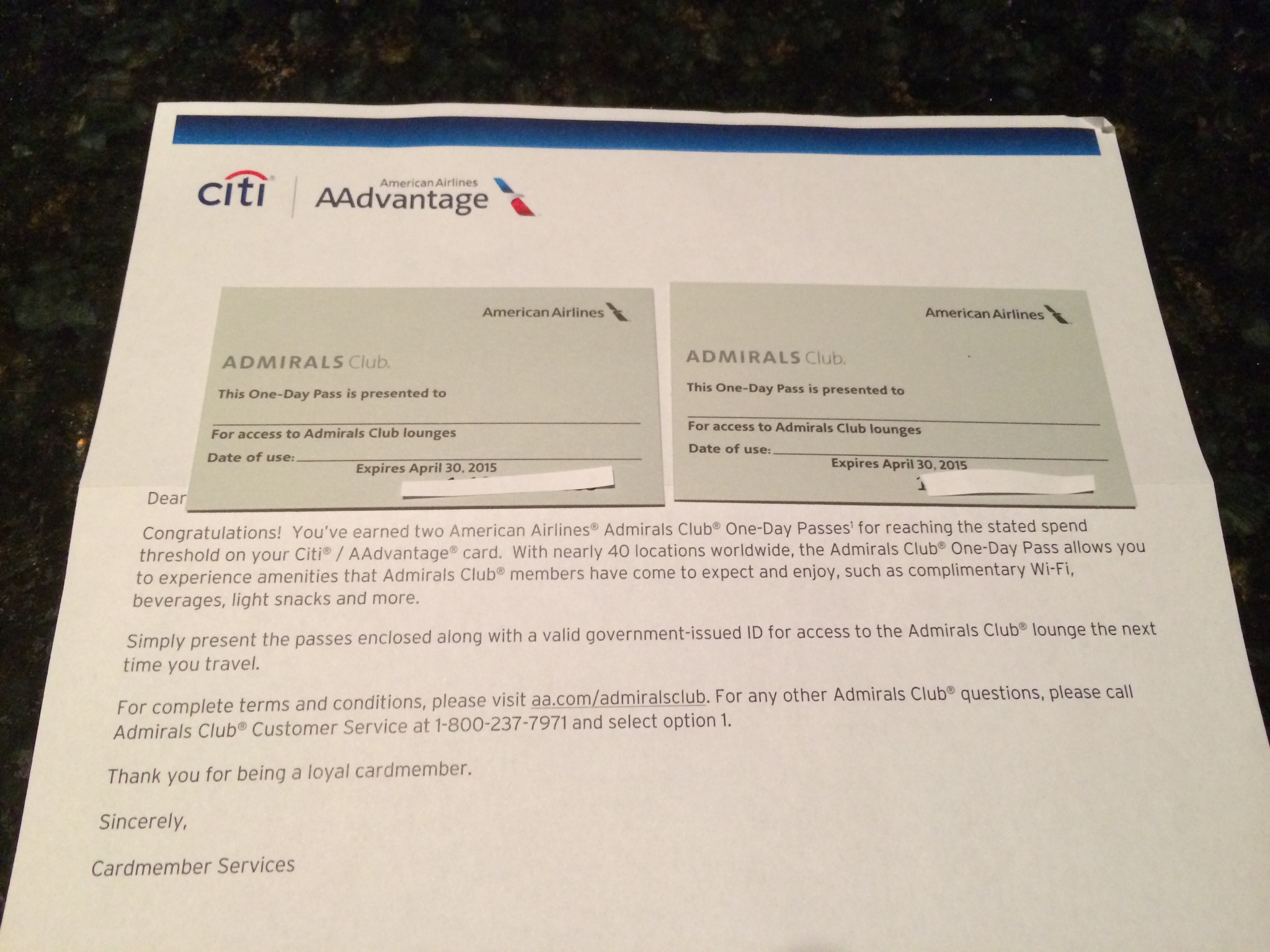

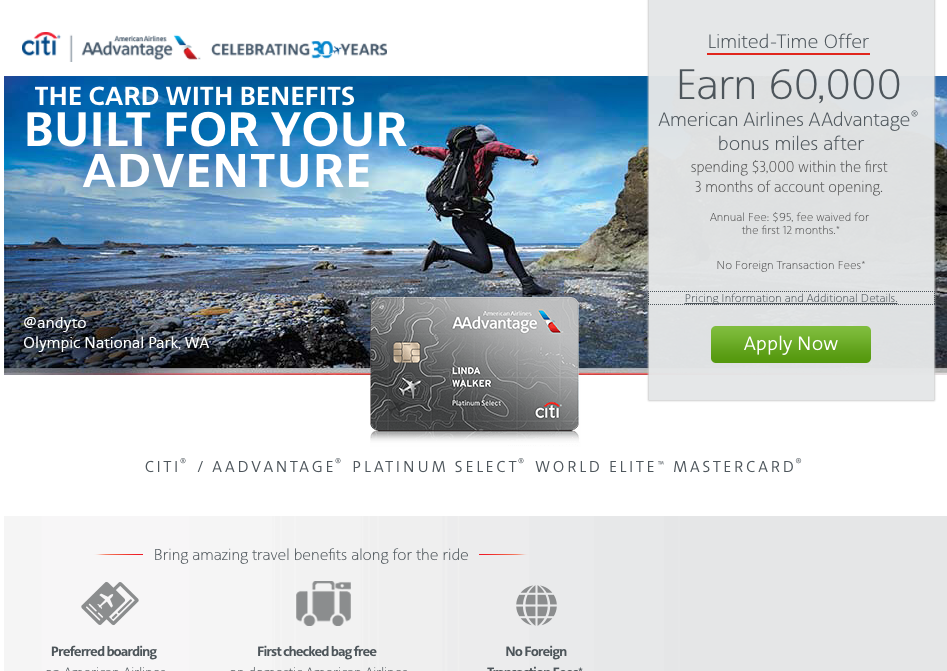

While pre-approval marketing tries to find customers who easily qualify for the card's minimum requirements, a pre-approval doesn't necessarily mean you'll be approved for a card when you file an application. You can view the rewards cards available from Citi here.Ĭredit card pre-approval is a type of e-mail and snail mail promotion by card issuers to help find potential cardholders. Depending on the rewards card, you could receive points, miles, or cash back.

Citibusiness online approval for free#

You can view your FICO® score, updated monthly, for free with select Citi cards. It's a good idea to know your credit score before you apply for any new credit cards. Some credit cards, such as secured credit cards, may not even require a minimal credit score at all. Check your credit scoreĬredit scores calculate the likelihood that you'll pay back loans based on a number that factors in your current debts, your past debts, and payment history for both past and present loans.ĭifferent credit cards will have different minimum credit score requirements to receive approval. The credit card application process breaks down into a few basic steps: 1. To apply for a credit card, you should first familiarize yourself with the application process. Let's take a look at how you begin the credit card application process. Learning more about the process can help you start strong when using a card and keep you from defaulting on your payments in the future. These questions are important when you're looking for a credit card. What are some online and in person ways to apply for a credit card? What documents do I need? And is there an application fee? For first-timers and existing users, the credit card application process can become confusing.

0 kommentar(er)

0 kommentar(er)