Initial adjustment cap: The first number indicates the initial adjustment cap.It’s common for caps to be based on a first adjustment, subsequent adjustments, and a lifetime cap. Read More: 10/1 ARM: Your Guide to 10-Year Adjustable-Rate Mortgages Interest rate capsĮven though your mortgage rate adjusts regularly with a 7/1 ARM, following the initial fixed period, there are caps on how high the rate can go. Tip: Ask your lender to find out which index it uses, along with the margin it adds to the index. For example, if you have a margin of 3.5% and your rate adjusts based on the SOFR - and the SOFR is at 0.15% - your new mortgage rate would be 3.65%. Margin: Your lender adds a fixed percentage on top of the index rate to get your new interest rate.

Other indexes that could be used include the Constant Maturity Treasuries (CMT) and the Cost of Funds Index (COFI). lenders are instead moving to the Secured Overnight Financing Rate (SOFR).

However, LIBOR is being phased out and many U.S. In the past, it was common for mortgage lenders to use the London Interbank Offered Rate (LIBOR).

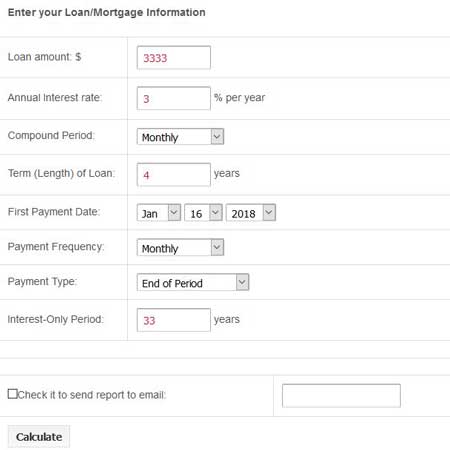

NMLS # 1681276, is referred to here as "Credible." Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Most borrowers intend to refinance an interest-only ARM before the interest-only period ends, but a reduction in home equity can make this difficult.Our goal is to give you the tools and confidence you need to improve your finances. Additionally, because the mortgage principal balance is not reduced during the interest-only period, the rate at which home equity increases, or decreases, is entirely dependent upon home-price appreciation. Not only do borrowers assume the risk that interest rates will rise, but they will also face a ballooning payment once the interest-only period ends. Interest-only adjustable rate mortgages can be risky financial products. While interest-only mortgages translate into lower payments initially, they also mean you aren't building up equity and will see a jump in payments when the interest-only period ends.Interest-only payments may be made for a specified time period, may be given as an option, or may last throughout the duration of the loan with a balloon payment at the end.An interest-only ARM is an adjustable mortgage where only interest payments are due for the initial period of the loan, as opposed to payments including both principal and interest.

0 kommentar(er)

0 kommentar(er)